Executive Summary

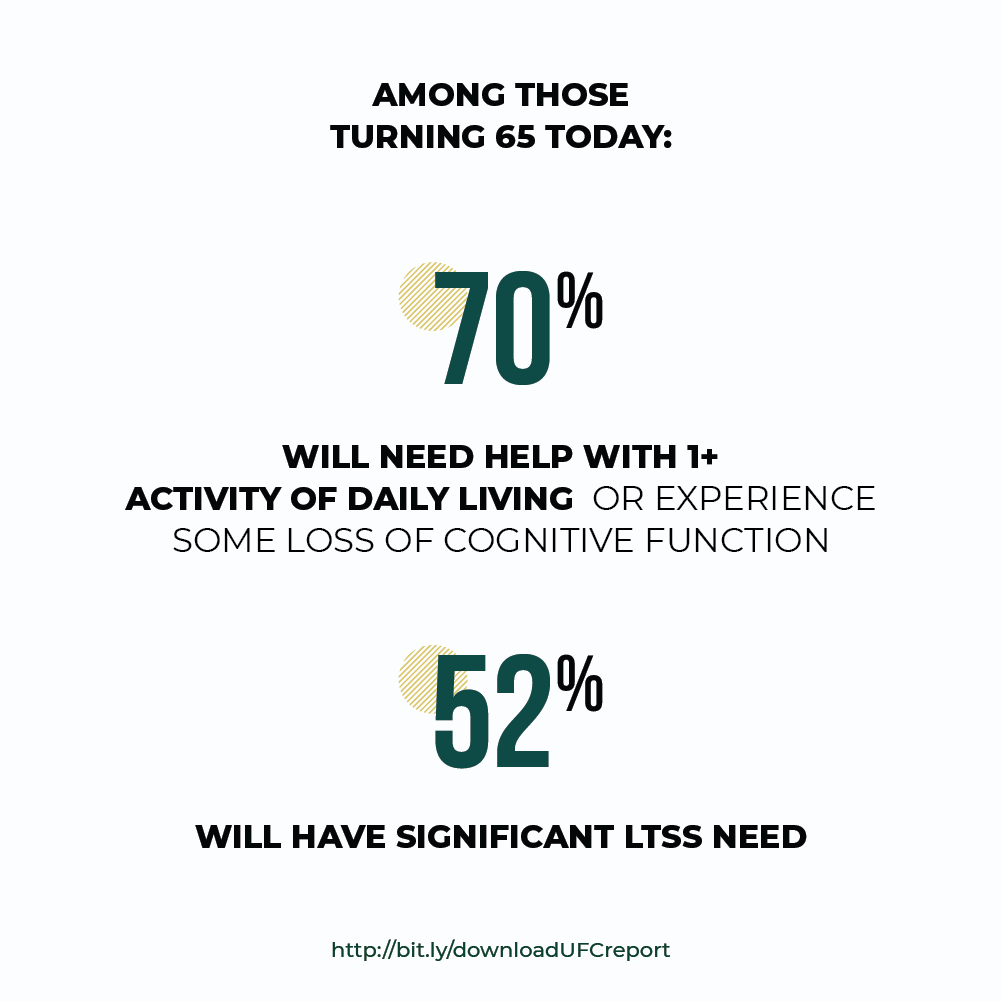

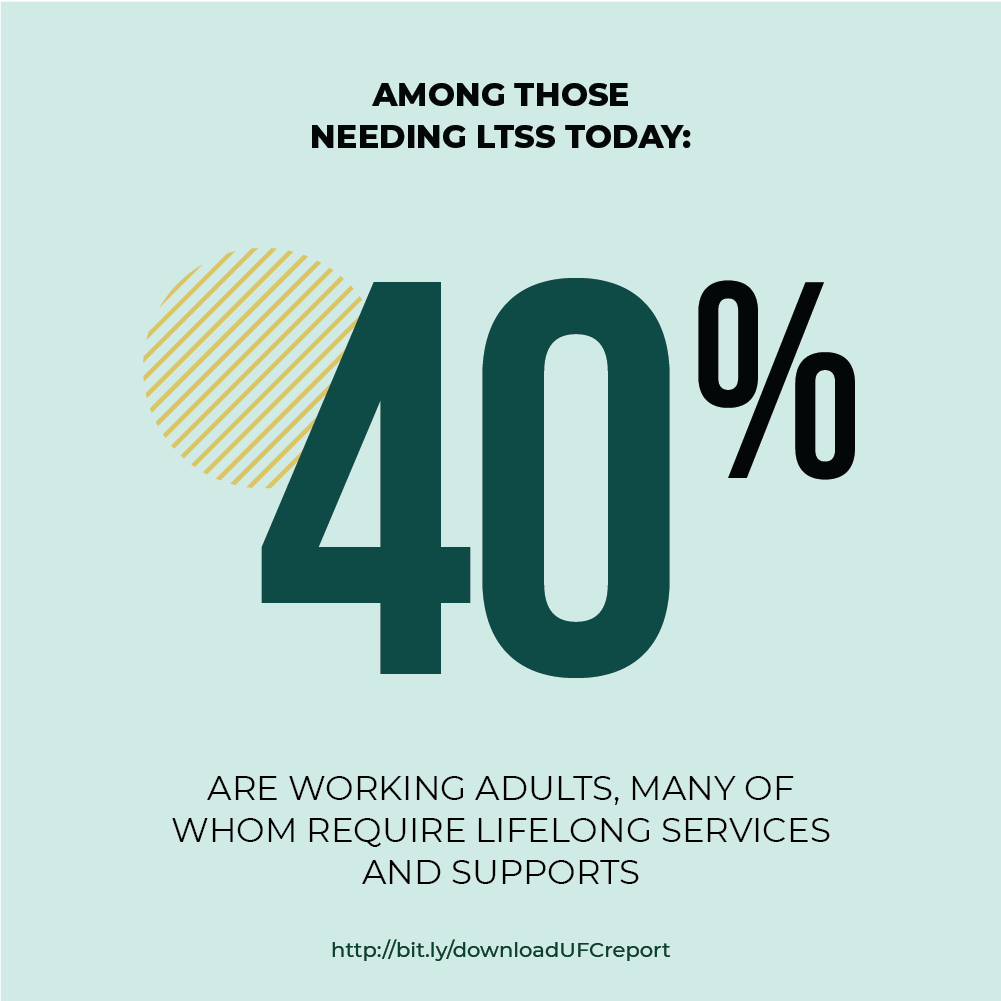

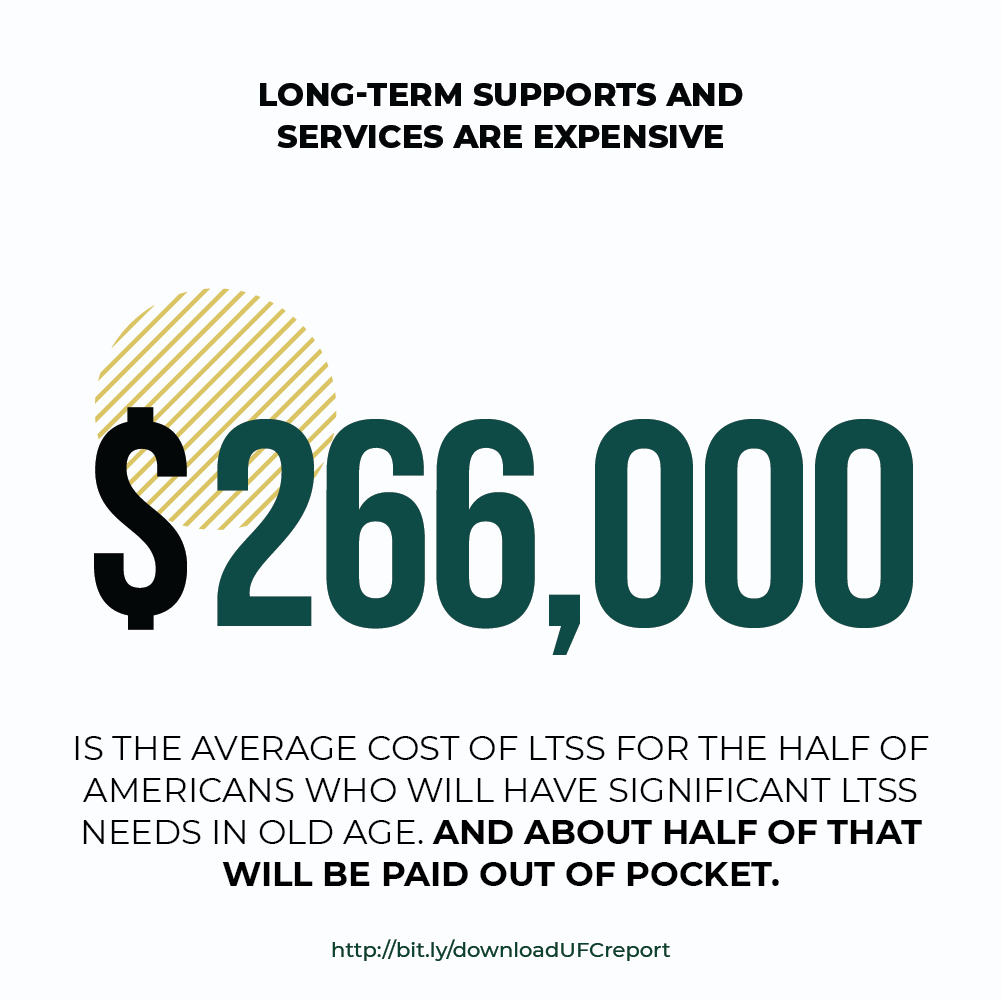

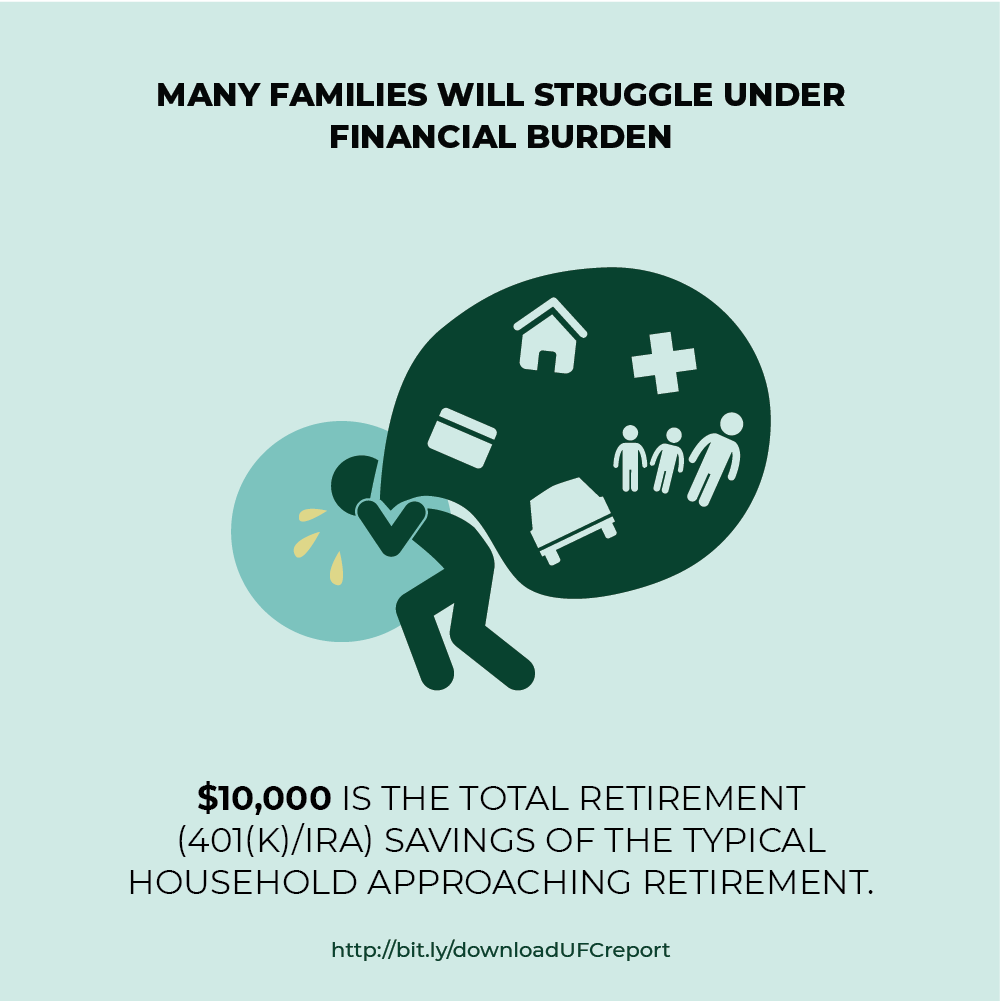

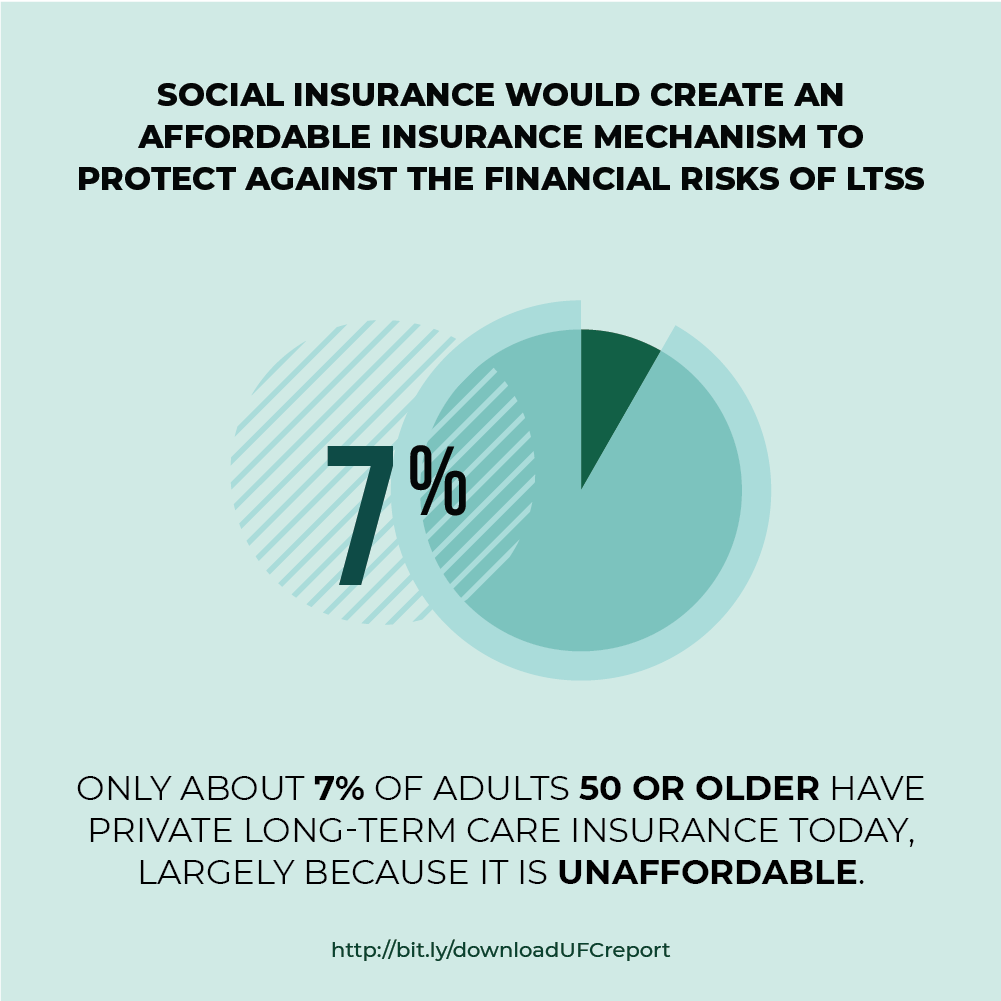

Long-term services and supports (LTSS) needs are growing and for a variety of reasons families are becoming less able to meet them. One in two of those turning 65 today will need LTSS. Around 40 percent of those needing LTSS today are under 65; many will require lifelong services and supports. LTSS can be costly both for those needing care and for family caregivers. These costs often come at a time when individuals and their families are most vulnerable and in a context where they have had little opportunity to prefund or insure against such risks. Thus, the fundamental LTSS financing problem today is the absence of an effective insurance mechanism to protect people against these costs.

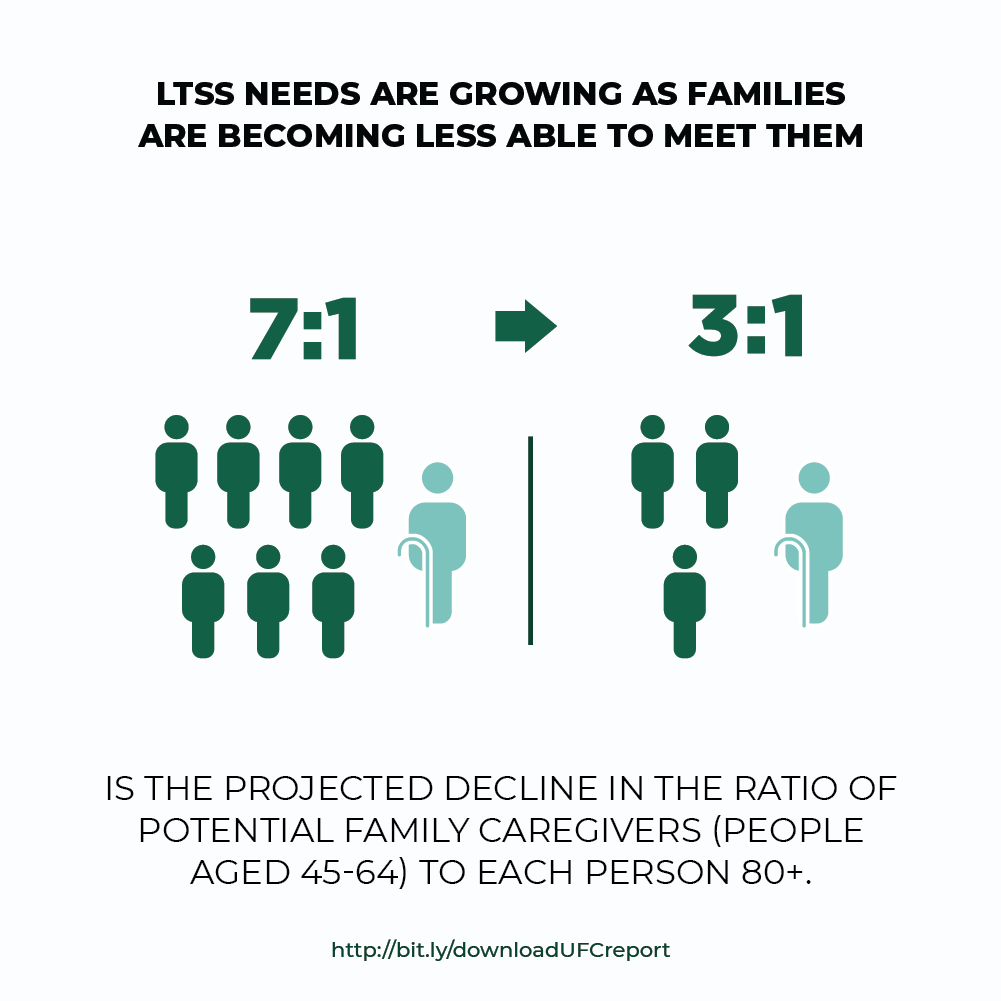

The majority of LTSS today is provided by family and friends, often to the detriment of their health and financial security. In the coming decades, most professional care will be paid for by families out of pocket. Most of the remainder of paid care will be covered by Medicaid, the primary public payer of LTSS. To qualify for Medicaid, however, a person must have low income and may not have assets above a certain level. Many middle-income people “spend down”—they use their assets to pay for care until they have very little left and qualify for Medicaid. Those who qualify for Medicaid (whether low- or middle-income) must contribute most of their income to their care costs, losing financial independence, and may be forced to enter a nursing home because they cannot access sufficient home- and community-based services or afford to remain at home.

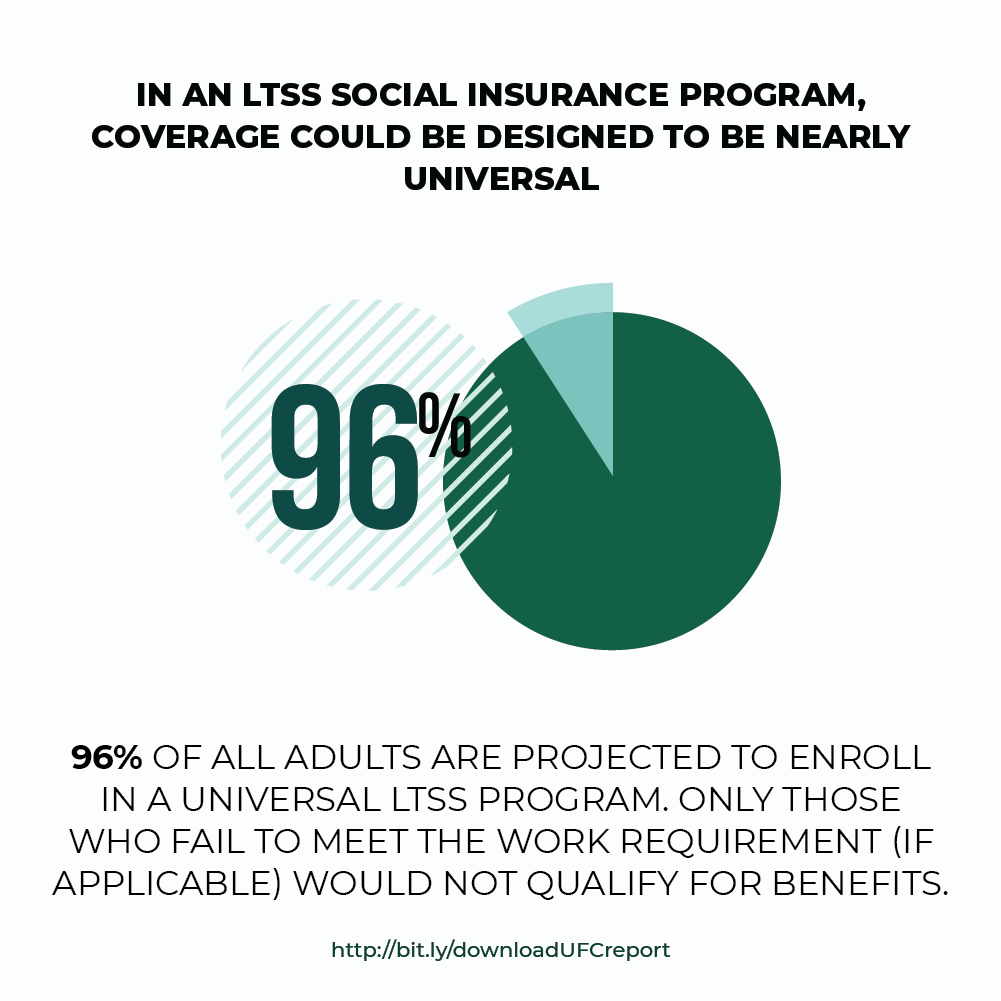

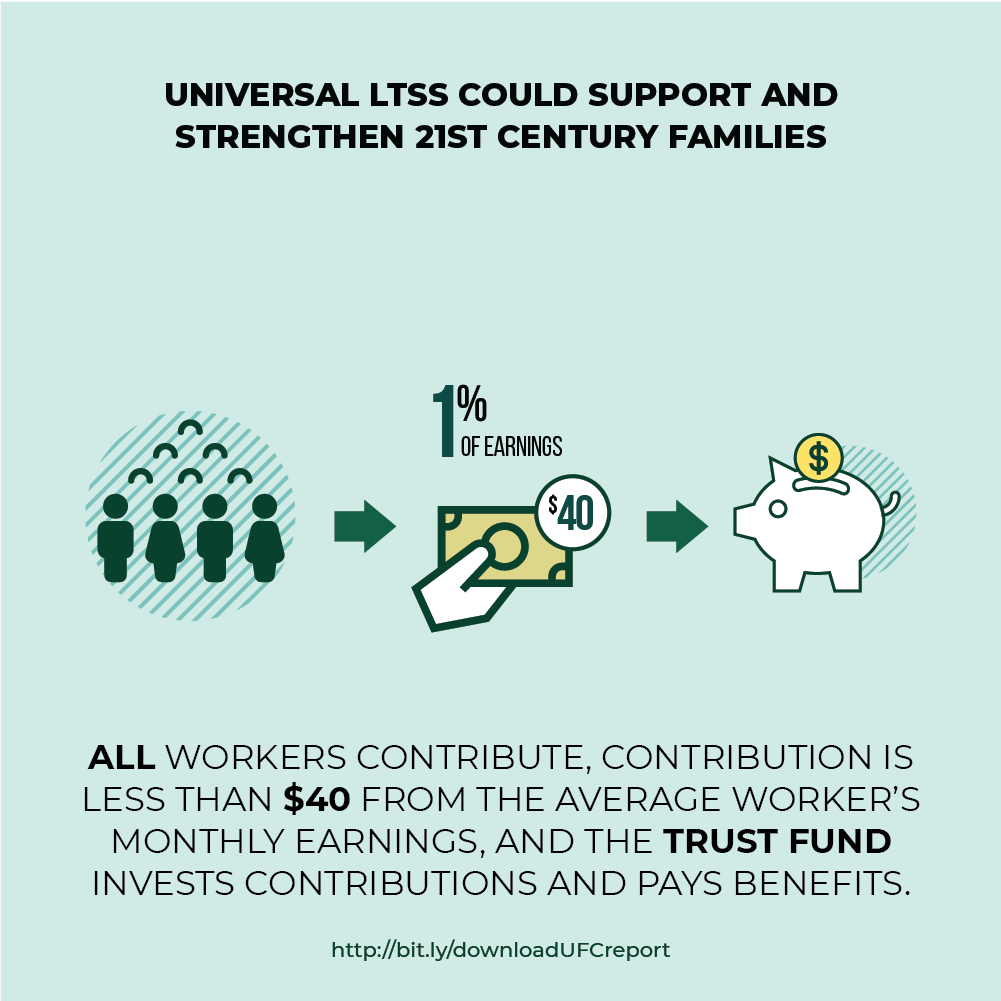

States are grappling with the growing demand for LTSS as their Baby Boomers age. They already struggle to keep up with the growing need in the context of budget constraints. Social insurance could provide universal, affordable LTSS coverage. Indeed, Washington State enacted an LTSS social insurance program in 2019. As other states consider similar measures, policymakers need to be mindful of key design issues, including:

- Program structure. Who will be eligible for the program’s benefits? How will generational transition issues be addressed? Will front-end, back-end (catastrophic), or temporally unlimited coverage be offered?

- Financing approach. How will the program be financed? Will it be funded through a payroll tax, an income tax, or some other dedicated revenue source? And will it be financed on a pay-as-you-go or prefunded basis?

- Program integration. How will the new program interface with Medicaid LTSS and private long-term care insurance?

- Program implementation strategy. How will the program be administered, revenues collected and managed, eligibility determined, and program integrity ensured?

The chapter discusses tradeoffs among alternative approaches to these core design choices and compares the cost of different structural approaches by financing source. Also illustrated is how proactive policies could lessen the financial pressure on state Medicaid budgets, reduce care burdens on families, and also support significant job creation in one of the fastest-growing sectors of the economy—personal care and home health care.

Judith Feder

Eileen J. Tell

Marc Cohen

INFOGRAPHICS

CHAPTER 3 INFOGRAPHIC DOWNLOADS (PDFS)

Want to learn more? Email us at:

info@caringacross.org